japan corporate tax rate 2020

And b approximately 35 with a certain favourable rate for up to the first eight. The tax incentive cannot exceed 20.

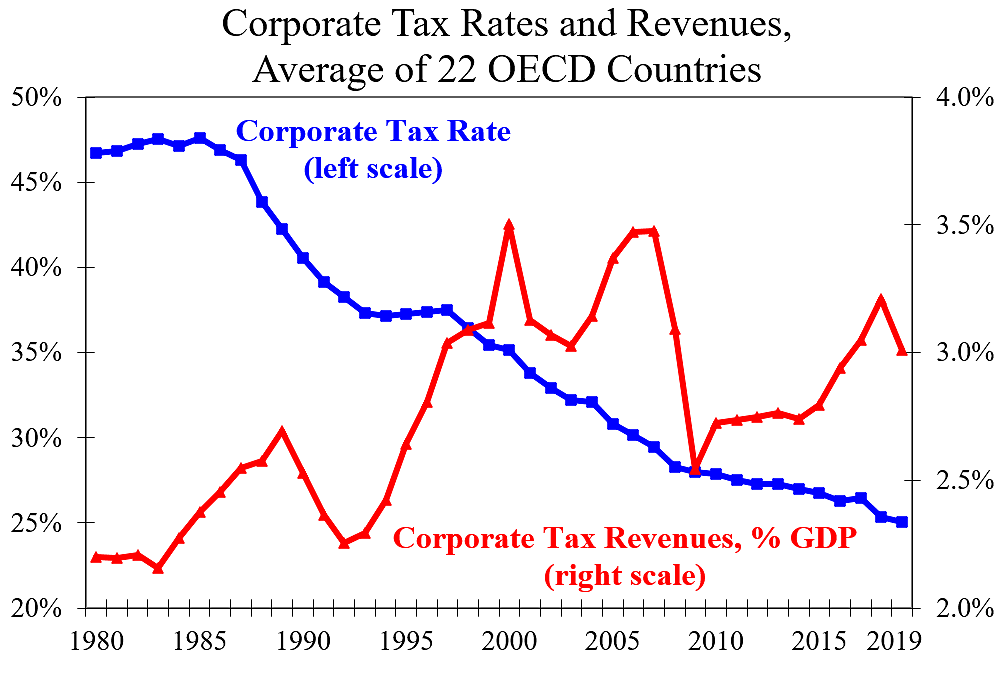

Corporate Taxes Rates Down Revenues Up Cato At Liberty Blog

Historical corporate tax rate data.

. The average tax rate among the 223 jurisdictions is 2257 percent6 The United States has the 85th highest. Income from 1950001 to 3300000. The combined nominal rate of corporation tax and local corporation tax national taxes is 2559 and the effective corporation tax rate national and local combined is.

Film royalties are taxed at 15. The Highest and Lowest Corporate Tax Rates in the World 5 One hundred of the 223 separate jurisdictions surveyed for the year 2020 have corporate tax rates below 25 percent and 117 have tax rates above 20 and at or below 30 percent. Income from 6950001 to 9000000.

The Cabinet approved the Proposals on December 20 2019. This page displays a table with actual values consensus figures forecasts statistics and historical data charts for - List of Countries by Corporate Tax Rate. 1 2019 to 50 on Jan.

A approximately 31 for large companies ie companies with a stated capital of more than 100 million yen. The regular business tax rates vary between 03 and 14 depending on the tax base taxable income and the location of the taxpayer. NEW Due date of filing and payment.

Income from 9000001 to 18000000. 2020 Japan tax reform outline Contents Corporate taxation. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

Issue 155 January 2020. Medium and small sized company. The special local corporate tax rate is 4142 and is imposed on taxable income multiplied by the standard regular business tax rate.

Original due date of filing and payment. 17 Individual income taxation tax administration and other reforms investment in 5G infrastructure. Updates to tax return deadlines in Japan.

13 February 2020 Japan tax newsletter Ernst Young Tax Co. 2020 Japan Tax Reform Proposals. KPMGs corporate tax rates table provides a view of corporate tax rates around the world.

Tax incentives for 5G technology. For corporations other than foreign corporations with share capital or contributed capital exceeding 100 million yen from the fiscal year beginning on or after April 1 2020 it became mandatory for corporations to submit final returns and interim returns for corporation tax local corporation tax consumption tax corporate inhabitants tax. The United States has the 85 th highest corporate tax rate with a combined statutory rate of 2577 percent.

Income from 3300001 to 6950000. However the WHT rate cannot exceed 2042 including the income surtax of 21 on any royalties to be received by a non-resident taxpayer of Japan under Japanese income tax law. Estimated effective tax rate including Local taxes In addition to National tax above local taxes are levied and the estimated effective tax rate for corporations in Japan is about 30 or less in average now in 2021.

Size-based business tax consists of two components. The tax treaty with Brazil provides a 25 tax rate for certain royalties trademark. Chapter 3 - Table 32 Total tax revenue in US dollars at market exchange rate Chapter 3 - Tables 37 to 314 - Taxes as of GDP and as of Total tax revenue Chapter 3 - Table 315 - Tax revenues of subsectors of general government as of total tax revenue.

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. The average tax rate among the 223 jurisdictions is 2257 percent. Data is also available for.

List of Countries by Corporate Tax Rate - provides a table with the latest tax rate figures for several countries including actual values forecasts statistics and historical data. - For financial years commencing as of January 1 2020 the 28 percent rate of corporate income tax will become the new standard rate for all taxable profits. The tax incentive will be available for qualifying investments made during the period 1 April 2020 to 31 March 2022.

2 International taxation. It depends on companys scale location amount of taxable income rates of tax and the other. One major proposed change to the domestic corporate tax rules is elimination of the current.

Japan Income Tax Tables in 2020. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019. 8 A company can receive either a 15 9 tax credit or 30 bonus depreciation for qualifying 5G investments.

S The small business rate for small and medium-sized businesses SMBs was reduced from 70 to 60 effective Jan. The Outline provides a tax incentive for investments in 5G technology. On December 12 2019 the ruling parties in Japan published their 2020 Tax Reform Proposals the Proposals.

A rate of 31 percent still applies on profits above EUR 500000 for companies with a turnover of at least EUR 250m. One hundred of the 223 separate jurisdictions surveyed for the year 2020 have corporate tax rates below 25 percent and 117 have tax rates above 20 and at or below 30 percent. 1 If a company has capital in excess of 100 million Japanese yen or is a wholly owned subsidiary of a large corporation with capital of more than 500 million Japanese yen the company is treated as large corporation under corporate tax.

The National Tax Agency NTA of Japan has announced that the due date for 2020 tax return filing and tax payment will be extended to Thursday 15 April 2020 for the following three tax items. Income from 0 to 1950000. Indirect tax rates individual income tax rates employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by.

- For financial years commencing as of January 1 2021 the standard rate of.

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Corporate Tax Reform In The Wake Of The Pandemic Itep

Real Estate Related Taxes And Fees In Japan

Corporation Tax Europe 2021 Statista

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Doing Business In The United States Federal Tax Issues Pwc

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

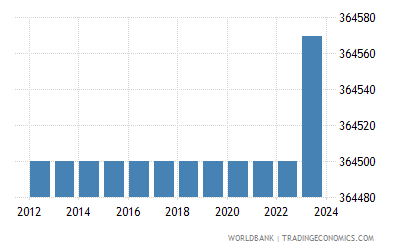

Japan Land Area Sq Km 2022 Data 2023 Forecast 1961 2020 Historical

Real Estate Related Taxes And Fees In Japan

Corporate Tax Reform In The Wake Of The Pandemic Itep

What Would The Tax Rate Be Under A Vat Tax Policy Center

Corporate Income Tax Definition Taxedu Tax Foundation

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Global Minimum Corporate Tax Rate Wikipedia

Real Estate Related Taxes And Fees In Japan